10:30am-3:00pm(JST)

10:30am-5:00pm(JST)

学生・研究者向け

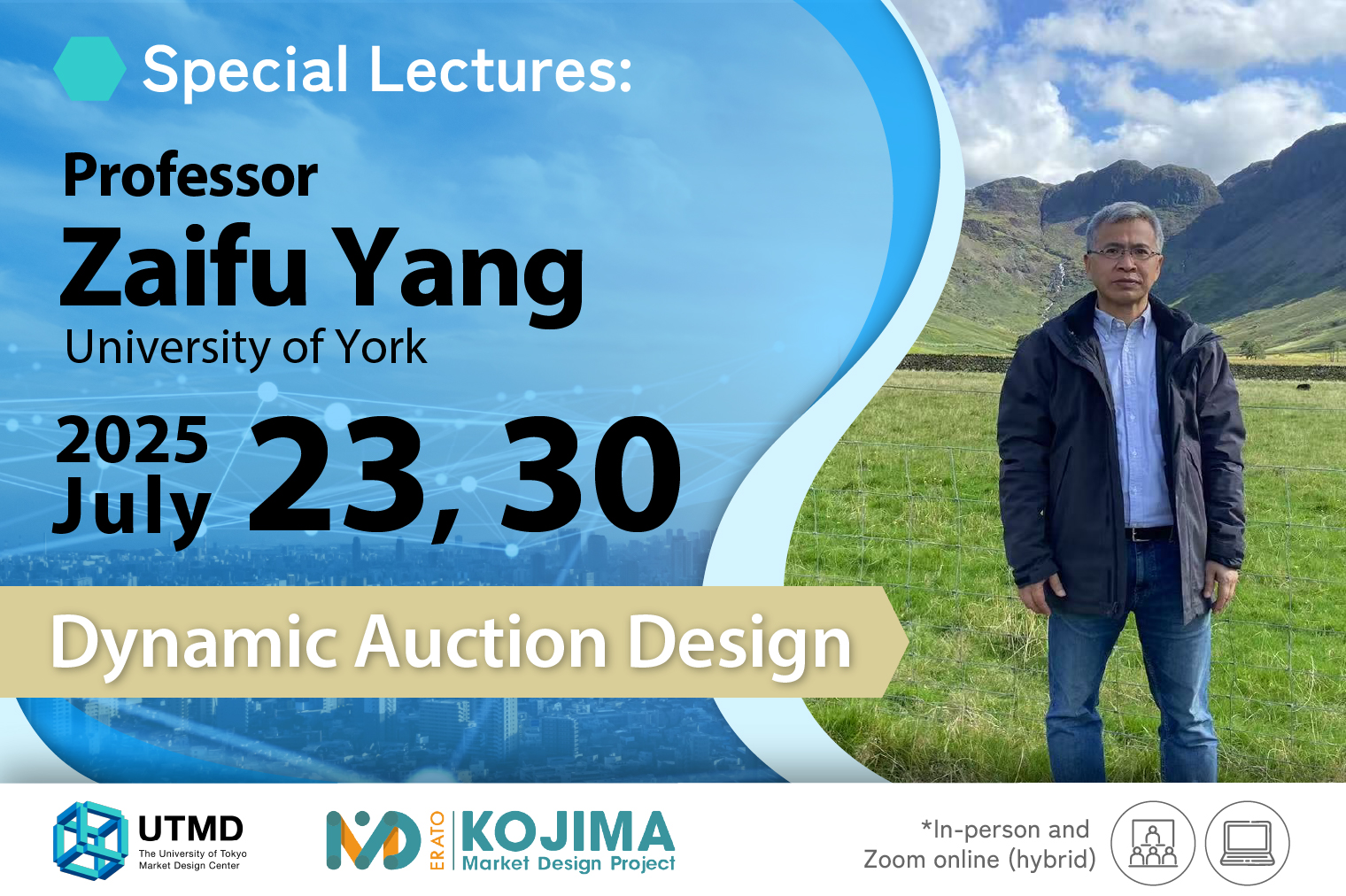

特別連続講義 “Dynamic Auction Design” Professor Zaifu Yang(University of York)

2025年7月23日(水)、30日(水)に、Professor Zaifu Yang(University of York)による特別連続講義 “ Dynamic Auction Design” (同日各2回開催の全4回)を開催いたします。

※第1回、第2回のスライドを公開しました(2025年7月22日)。

※第1回スライドの改訂版および第3回、第4回のスライドを公開しました(2025年7月29日)。

※第3回スライドの改訂版を公開しました(2025年7月31日)。

講義案内

日時:

- 第1回 7月23日(水)Lecture 1. 10:30am-12:00pm(JST)

- 第2回 7月23日(水)Lecture 2. 1:30pm-3:00pm(JST)

- 第3回 7月30日(水)Lecture 3. 10:30am-12:00pm(JST)

- 第4回 7月30日(水)Lecture 4. 3:30pm-5:00pm(JST)

会場:東京大学大学院経済学研究科(本郷キャンパス)学術交流棟(小島ホール) 第1セミナー室

開催方法: 対面とZoomを用いたハイブリッド開催

言語:英語

オーガナイザー:

- 小島 武仁(UTMDセンター長/ERATO小島マーケットデザインプロジェクト研究総括)

- 神取道宏(特別教授/ERATO 小島マーケットデザインプロジェクト・研究理論グループリーダー)

参加方法について

参加費は無料ですが、事前の参加登録が必要です。下記のフォームから登録をお願いします。

講師紹介

Professor Zaifu Yang

Department of Economics Professor

University of York

プログラム

Dynamic Auction Design

Auctions are among the oldest and also youngest market mechanisms for allocating scarce resources. In the last three decades, dynamic auctions for selling multiple items have become phenomenally popular. Such auctions have been extensively used by governments in the world to sell spectrum licenses and pollution rights, to procure goods and services, and to privatize state companies, and by firms to sell virtually all kinds of commodities. This minicourse consists of the following four lectures and tries to reflect the state-of-the-art dynamic auction design for selling multiple items. Each lecture will last about 90 minutes. There will be a five-minute break in each lecture.

| 日時 | 会場 | サブタイトル |

|---|---|---|

第1回 7/23(水) | 小島ホール1階 第1セミナー室 | Lecture 1 |

第2回 7/23(水) | Lecture 2 | |

第3回 7/30(水) | Lecture 3 | |

第4回 7/30(水) | Lecture 4 |

※時間はすべて日本標準時です。

- References

- Ausubel L (2004) An efficient ascending-bid auction for multiple objects. Amer. Econom. Rev. 94(5):1452–1475.

- Ausubel L (2006) An efficient dynamic auction for heterogeneous commodities. Amer. Econom. Rev. 96(3):602–629.

- Ausubel L, Milgrom P (2002) Ascending auctions with package bidding. B.E. J. Theor. Econom. 1(1):20011001.

- Baldwin E, Klemperer P (2019) Understanding preferences: “Demand types”, and the existence of equilibrium with indivisibilities. Econometrica 87(3):867–932.

- Clarke E (1971) Multipart pricing of public goods. Public Choice 11:17–33.

- Crawford V, Knoer E (1981) Job matching with heterogeneous firms and workers. Econometrica 49(2):437–450.

- Demange G, Gale D, Sotomayor M (1986) Multi-item auctions. J. Political Econom. 94(4):863–872.

- Fujishige S, Yang Z (2003) A note on Kelso and Crawford’s gross substitutes condition. Math. Oper. Res. 28(3):463–469.

- Fujishige S, and Yang Z (2025) A Universally Efficient Dynamic Auction Mathematics of Operations Research, Articles in Advance, pp. 1–23, © 2025 INFORMS.

- Groves T (1973) Incentives in teams. Econometrica 41(4):617–631.

- Gul F, Stacchetti E (1999) Walrasian equilibrium with gross substitutes. J. Econom. Theory 87(1):95–124.

- Gul F, Stacchetti E (2000) The English auction with differentiated commodities. J. Econom. Theory 92(1):66–95.

- Kelso A, Crawford V (1982) Job matching, coalition formation, and gross substitutes. Econometrica 50(6):1483–1504.

- Koopmans T, Beckmann M (1957) Assignment problems and the location of economic activities. Econometrica 25(1):53–76.

- Krishna V (2002) Auction Theory (Academic Press, Cambridge, MA).

- Leonard H (1983) Elicitation of honest preferences for the assignment of individuals to positions. J. Political Econom. 91(3):1–36.

- Milgrom P (2000) Putting auction theory to work: The simultaneous ascending auction. J. Political Econom. 108(2):245–272.

- Milgrom P (2004) Putting Auction Theory to Work (Cambridge University Press, Cambridge, UK).

- Milgrom P (2017) Discovering Prices: Auction Design in Markets with Complex Constraints (Columbia University Press, New York).

- Murota K (2003) Discrete Convex Analysis (Society for Industrial and Applied Mathematics, Philadelphia).

- Sun N, Yang Z (2006) Equilibria and indivisibilities: Gross substitutes and complements. Econometrica 74(5):1385–140

- Sun N, Yang Z (2009) A double-track adjustment process for discrete markets with substitutes and complements. Econometrica 77(3): 933–952.

- Sun Y, Yang Z (2014) An efficient and incentive compatible dynamic auction for multiple complements. J. Political Econom. 122(2): 422–466.

- Yang Z, and Yu J (2024) An efficient and general ascending menu auction under budget constraints. J. of Mechanism and Institution Design. 9(1): 105-130.

- Yang Z, and Yu J (2025) An efficient and incentive-compatible dynamic core-selecting auction under budget constraints.

- Vickrey W (1961) Counterspeculation, auctions, and competitive sealed tenders. J. Finance 16(1):8–37.

お問い合わせ

東京大学マーケットデザインセンター (UTMD)

東京大学大学院経済学研究科

メール: market-design[at]e.u-tokyo.ac.jp

電話番号: 03-5841-3441