10:30am-3:00pm(JST)

10:30am-5:00pm(JST)

For Researchers

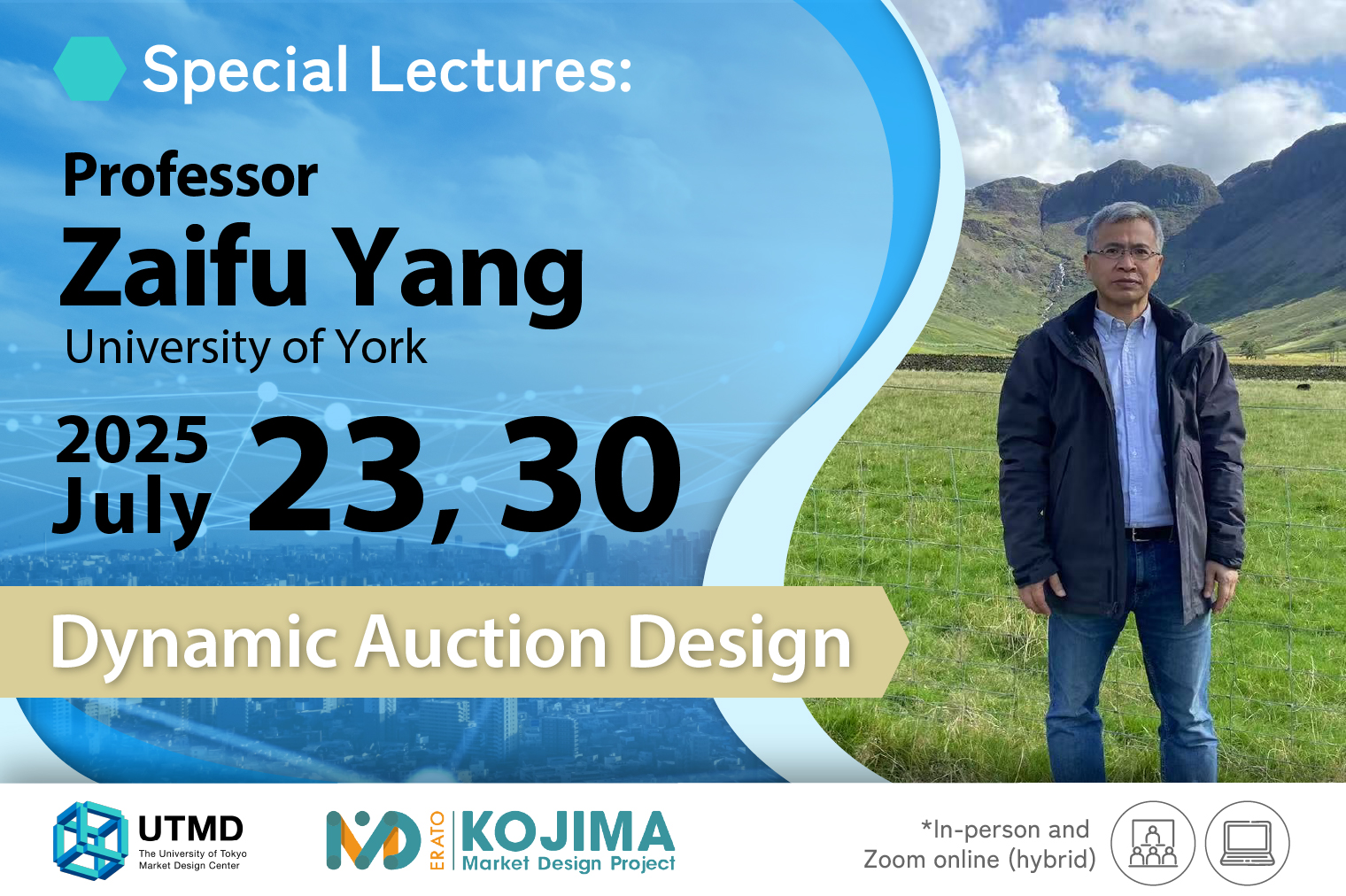

Special Lectures:”Dynamic Auction Design” Professor Zaifu Yang(University of York)

We will host the special lectures “Dynamic Auction Design” by Professor Zaifu Yang (University of York) on July 23rd and 30th, 2025 (JST).

*The slides for Lectures 1 and 2 have been uploaded (July 22, 2025).

*Revised version of the slides for Lecture 1 and the slides for Lectures 3 and 4 have been uploaded (July 29, 2025).

*Revised version of the slides for Lecture 3 has been uploaded (July 31, 2025).

Workshop Information

Dates & Times:

- Lecture 1. Wednesday, July 23rd, 2025, 10:30am-12:00pm(JST)

- Lecture 2. Wednesday, July 23rd, 2025, 1:30pm-3:00pm(JST)

- Lecture 3. Wednesday, July 30th, 2025, 10:30am-12:00pm(JST)

- Lecture 4. Wednesday, July 30th, 2025, 3:30pm-5:00pm(JST)

Venue:

Seminar Room 1 on the 1st floor of the Economics Research Annex (Kojima Hall), Graduate School of Economics, The University of Tokyo

Form of the event: In-person and Zoom online (hybrid)

Language: English

Co-host: ERATO KOJIMA Market Design Project

Organizers:

- Fuhito Kojma (Director of UTMD, Research Director of ERATO KOJIMA Market Design Project)

- Michihiro Kandori (University Professor/ Economic Theory Group Leader, ERATO Kojima Market Design Project)

About registration

There is no registration fee, but pre-registration is required.

Please sign up through the form below for both online and in-person registration.

Speaker Profile

Professor Zaifu Yang

Department of Economics Professor

University of York

Program

Dynamic Auction Design

Auctions are among the oldest and also youngest market mechanisms for allocating scarce resources. In the last three decades, dynamic auctions for selling multiple items have become phenomenally popular. Such auctions have been extensively used by governments in the world to sell spectrum licenses and pollution rights, to procure goods and services, and to privatize state companies, and by firms to sell virtually all kinds of commodities. This minicourse consists of the following four lectures and tries to reflect the state-of-the-art dynamic auction design for selling multiple items. Each lecture will last about 90 minutes. There will be a five-minute break in each lecture.

| Date & Time | Venue | Subtitle |

|---|---|---|

Wed, July 23rd | Seminar Room 1 on the 1st floor of the Kojima Hall | Lecture 1 |

Wed, July 23rd | Lecture 2 | |

| Wed, July 30th, 10:30am-12:00pm | Lecture 3 | |

| Wed, July 30th, 3:30pm-5:00pm | Lecture 4 |

*All times are Japan Standard Time.

- References

- Ausubel L (2004) An efficient ascending-bid auction for multiple objects. Amer. Econom. Rev. 94(5):1452–1475.

- Ausubel L (2006) An efficient dynamic auction for heterogeneous commodities. Amer. Econom. Rev. 96(3):602–629.

- Ausubel L, Milgrom P (2002) Ascending auctions with package bidding. B.E. J. Theor. Econom. 1(1):20011001.

- Baldwin E, Klemperer P (2019) Understanding preferences: “Demand types”, and the existence of equilibrium with indivisibilities. Econometrica 87(3):867–932.

- Clarke E (1971) Multipart pricing of public goods. Public Choice 11:17–33.

- Crawford V, Knoer E (1981) Job matching with heterogeneous firms and workers. Econometrica 49(2):437–450.

- Demange G, Gale D, Sotomayor M (1986) Multi-item auctions. J. Political Econom. 94(4):863–872.

- Fujishige S, Yang Z (2003) A note on Kelso and Crawford’s gross substitutes condition. Math. Oper. Res. 28(3):463–469.

- Fujishige S, and Yang Z (2025) A Universally Efficient Dynamic Auction Mathematics of Operations Research, Articles in Advance, pp. 1–23, © 2025 INFORMS.

- Groves T (1973) Incentives in teams. Econometrica 41(4):617–631.

- Gul F, Stacchetti E (1999) Walrasian equilibrium with gross substitutes. J. Econom. Theory 87(1):95–124.

- Gul F, Stacchetti E (2000) The English auction with differentiated commodities. J. Econom. Theory 92(1):66–95.

- Kelso A, Crawford V (1982) Job matching, coalition formation, and gross substitutes. Econometrica 50(6):1483–1504.

- Koopmans T, Beckmann M (1957) Assignment problems and the location of economic activities. Econometrica 25(1):53–76.

- Krishna V (2002) Auction Theory (Academic Press, Cambridge, MA).

- Leonard H (1983) Elicitation of honest preferences for the assignment of individuals to positions. J. Political Econom. 91(3):1–36.

- Milgrom P (2000) Putting auction theory to work: The simultaneous ascending auction. J. Political Econom. 108(2):245–272.

- Milgrom P (2004) Putting Auction Theory to Work (Cambridge University Press, Cambridge, UK).

- Milgrom P (2017) Discovering Prices: Auction Design in Markets with Complex Constraints (Columbia University Press, New York).

- Murota K (2003) Discrete Convex Analysis (Society for Industrial and Applied Mathematics, Philadelphia).

- Sun N, Yang Z (2006) Equilibria and indivisibilities: Gross substitutes and complements. Econometrica 74(5):1385–140

- Sun N, Yang Z (2009) A double-track adjustment process for discrete markets with substitutes and complements. Econometrica 77(3): 933–952.

- Sun Y, Yang Z (2014) An efficient and incentive compatible dynamic auction for multiple complements. J. Political Econom. 122(2): 422–466.

- Yang Z, and Yu J (2024) An efficient and general ascending menu auction under budget constraints. J. of Mechanism and Institution Design. 9(1): 105-130.

- Yang Z, and Yu J (2025) An efficient and incentive-compatible dynamic core-selecting auction under budget constraints.

- Vickrey W (1961) Counterspeculation, auctions, and competitive sealed tenders. J. Finance 16(1):8–37.

Contact Info

The University of Tokyo Market Design Center(UTMD)

Graduate School of Economics, the University of Tokyo

E-mail: market-design[at]e.u-tokyo.ac.jp

Phone: (+81)3-5841-3441