9:00am-12:20pm(JST)

学生・研究者向け

2025-26 Rising Stars in Market Design

UTMDは、12月1日に2025-26 アカデミックジョブマーケットに参加する若手研究者による国際ワークショップ “2025-26 Rising Stars in Market Design” を開催いたします。

開催概要

日時:2025年12月1日(月)9:00am-12:20pm (JST)

開催方法:Zoomを使ったオンライン開催となります。(事前登録制)

言語:英語

後援:科学研究費補助金(基盤S:小島武仁代表) 「マーケットデザインとその社会実装による社会科学の革新」21H04979

*撮影や録画、コンテンツの複製や無断利用はご遠慮ください。

*参加URLを他の方と共有することはお控えください。

参加方法について

参加費は無料ですが、事前の参加登録が必要です。下記のフォームから登録をお願いします。 過去に登録した方も下記リンクにて再度登録をお願いいたします。

締切: 2025年11月28日(金)昼12時まで

プログラム

| 時間 | スピーカー | タイトル |

|---|---|---|

| 9:00-10:00am | Simon Jantschgi | Competitive Combinatorial Exchange |

| 10:10-11:10am | Fernando Ochoa | Targeting and Price Pass-Through in Voucher Design: Evidence from Chile |

| 11:20am-12:20pm | Andrew Koh (Massachusetts Institute of Technology) | Robust Technology Regulation |

※時間はすべて日本標準時です。

スピーカー

Simon Jantschgi

(University of Zurich)

Title: Competitive Combinatorial Exchange

Abstract: We consider combinatorial exchanges where agents have (possibly random) endowments and ordinal preferences over bundles of indivisible goods. For any market instance, we show that there exists an approximately feasible, individually rational, and ordinally efficient lottery assignment. This assignment can be supported by prices derived from a novel competitive equilibrium concept, which we term a Budget-Relaxed Approximate Competitive Equilibrium (BRACE). Any BRACE can be implemented as a lottery over deterministic allocations that are approximately feasible, individually rational and efficient. When endowments are deterministic, it can be implemented over near-feasible weak core outcomes. Moreover, BRACEs are ordinally envy-free and ex-post envy-free up to one good (where envy is only justified if another agent’s endowment is either smaller or worth less in equilibrium). A mechanism that implements a BRACE is strategyproof in the large. Our framework can be used in many real-world market design applications, such as organ exchanges, tuition exchanges, time bank sharing, shift exchanges, and resource reallocation.

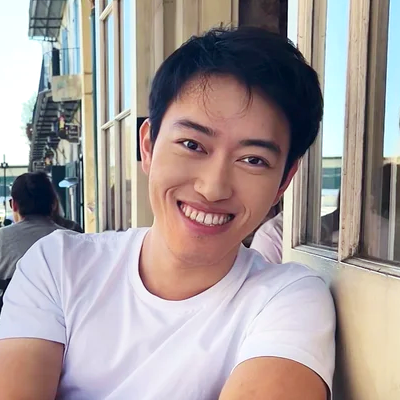

Fernando Ochoa

(New York University)

Title: Targeting and Price Pass-Through in Voucher Design: Evidence from Chile

Abstract: Vouchers are a common policy for expanding access to homeownership, yet their effectiveness remains contested due to concerns about targeting and price pass-through of subsidies. I study the equilibrium and distributional effects of targeted and rationed homeownership vouchers, using Santiago’s DS1 program as a case study—the largest homeownership voucher program in the OECD, subsidizing 7% of the city’s transactions. I build an equilibrium model of a housing market with vouchers whose demand incidence is determined by the endogenous composition of beneficiaries, and whose supply incidence operates along both intensive (transactions) and extensive (new development) margins. I estimate the model using novel data on voucher applications and use, real estate transactions, and new development surveys. I evaluate the equilibrium impacts of the program relative to a scenario without the program, finding that it increases homeownership rates and new development while raising prices, with total benefits offsetting the costs. Price increases exhibit significant heterogeneity across housing segments: they concentrate in beneficiaries’ preferred segments, harming unsubsidized low-income households. Counterfactual policies reveal a trade-off between targeting and price pass-through: policies that reduce price pass-through worsen targeting, as assistance goes to households more likely to become homeowners without the program.

Andrew Koh

(Massachusetts Institute of Technology)

Title: Robust Technology Regulation

Abstract: We analyze how uncertain technologies should be robustly regulated and how regulation should evolve with new information. An adaptive sandbox comprising a zero marginal tax up to an evolving quantity limit is (i) robust: it delivers optimal payoff guarantees when the agent’s learning process and/or preferences are chosen adversarially; (ii) dominant: it outperforms other robust and regular mechanisms across all agent learning processes and preferences; (iii) time-consistent: it is the only robust mechanism that can be implemented without commitment. Robustness is important: absent robust regulation, worst-case payoffs can be arbitrarily poor and are induced by weak but growing optimism that encourages excessive risk-taking. Our results offer optimality foundations for existing policy and speak directly to current debates around managing emerging technologies.

お問い合わせ

東京大学マーケットデザインセンター (UTMD)

東京大学大学院経済学研究科

メール: market-design[at]e.u-tokyo.ac.jp

電話番号: 03-5841-3441