We co-host workshops for researchers with the Center for International Research on the Japanese Economy (CIRJE).

Workshop information:

・The seminars are held in-person and online basically. (from October 2022)

・All times are Japan Standard Time (JST).

・Unless otherwise mentioned, presentations are in ENGLISH.

・For details and how to participate, please see Center for International Research on the Japanese Economy (CIRJE) Microeconomics Workshop 2023.

Schedule

Future Workshops

[Apr. 22, 2024] Kwok Hao Lee (National University of Singapore)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/4/22 (Mon) 10:25-12:10

Title: “Public Housing at Scale”

Abstract: We consider the design of a large-scale public housing program where consumers face dynamic tradeoffs over apartments rationed via lotteries and prices. We show, theoretically and empirically, that changing rules complements increasing supply. First, we present a motivating example in which supplying more housing leads households to strategically delay their applications. By waiting for “better” developments arriving tomorrow, households forgo mediocre developments available today, resulting in more vacancies. Turning to the data from the mechanism, we formulate a dynamic choice model over housing lotteries and estimate it. Under the existing mechanism, we find that increasing supply fails to lower wait times. However, when a strategyproof mechanism is implemented, vacancies and wait times fall, but prices on the secondary market rise. Under this new mechanism, building more apartments lowers wait times and reduces the upward pricing pressure on the secondary market.

[Apr. 23, 2024] Zhaohong Sun (Kyushu University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/4/23 (Tue) 10:25-12:10

Title: “Probabilistic Analysis of Stable Matching in Large Markets with Siblings”

Abstract: We consider a practical two-sided matching problem that assigns children to daycare centers. Notably, collective preferences expressed by siblings from the same family introduce complementarities that can result in the non-existence of stable matchings, a phenomenon observed in hospital-doctor matching problems involving couples. Intriguingly, stable matchings have been reported in real-world daycare markets, even when a significant number of applicants are children with siblings. Our research embarks on a systematic exploration to uncover the presence of stable matchings in these real-life markets. We conduct a probabilistic analysis of large random matching markets incorporating sibling preferences. Specifically, we examine scenarios where daycares exhibit similar priorities over children, a common characteristic observed in practical markets. Our analysis highlights that as the market size approaches infinity, the likelihood of stable matchings’ existence converges to 1. To facilitate our investigation, we introduce significant modifications to the Sorted Deferred Acceptance algorithm proposed by \citep{ABH14a}. These adaptations are essential to accommodate a more stringent stability concept, as the original algorithm may yield matchings that fail to adhere to this criterion. Leveraging our revised algorithm, we successfully identify stable matchings across all encountered real-life datasets. Additionally, we conduct comprehensive empirical investigations using synthetic datasets to validate the efficacy of our algorithm in identifying stable matchings.

[Apr. 30, 2024] Takeshi Murooka (Osaka University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/4/30 (Tue) 10:25-12:10

Title: “Procrastination Markets” Paul Heidhues, Botond K˝oszegi, Takeshi Murooka

Abstract: We develop models of markets with procrastinating consumers where competition operates or is supposed to operate — both through the initial selection of providers and through the possibility of switching providers. As in other work, consumers fail to switch to better options after signing up with a firm, so at that stage they exert little downward pressure on the prices they pay. Unlike in other work, however, consumers are not keen on starting with the best available offer, so price competition fails at this stage as well. In fact, a competition paradox results: an increase in the number of firms or the intensity of marketing increases the frequency with which a consumer receives switching offers, so it facilitates procrastination and thereby potentially raises prices. By implication, continuous changes in marketing costs can, through a self-reinforcing process, lead to discontinuous changes in market outcomes. Sign-up deals do not serve their classically hypothesized role of returning ex-post profits to consumers, and in some cases even exacerbate the failure of price competition. Consumer procrastination thus emerges as a novel source of competition failure that applies in situations where other theories of competition failure do not.

[May. 14, 2024] Donghao Zhu (Institute of Statistical Mathematics)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/5/14 (Tue) 10:25-12:10

Title: “Pricing Policy and Queue-Length Information Disclosure in On-Demand Service Platforms”

Abstract: Online service platforms, such as ride-hailing and freight exchanges, generate net revenues from commissions. Pricing and queue-length information are strategically used to attract users and maximize profit after considering platform costs. Dynamic pricing based on queue length can increase net revenue but might decrease user loyalty, incurring extra costs. Disclosing the queue length impacts customer balking behavior which influences user arrival rates. When displayed, customers balk at entering if they perceive the queue as too long. If concealed, balking is probabilistic, driven by the customers’ uncertainty about the waiting time. Using an 𝑀/𝑀/1 queueing model, we examine different pricing and information disclosure policies to maximize the expected profit of the platform. Optimizing the underlying semi-Markov decision process requires solving a non-convex quadratically constrained quadratic program. Through uniformization, we derive optimality equations and compare optimal prices, profits, and throughput. We identify unique thresholds for pricing and information policies. The preferred pricing policy depends on the extra cost of implementing dynamic pricing versus a static price. If this cost is low, then dynamic pricing is preferred; otherwise, a static pricing policy is preferred. The preferred information policy depends on the user’s sensitivity to queue-length information. Our results reveal that pricing and information policies are complementary. Specifically, both dynamic pricing and visible information policies increase expected profit, while static pricing and invisible information policies increase throughput.

[May. 21, 2024] Shota Ichihashi (Queen’s University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/5/21 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

[May. 30, 2024] In-Koo Cho (Emory University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/5/30 (Thu) 15:00 – 16:45

Title: “Collusive Outcomes Without Collusion” Inkoo Cho, Noah Williams

Abstract: We develop a model of algorithmic pricing that shuts down every channel for explicit or implicit collusion while still generating collusive outcomes. We analyze the dynamics of a duopoly market where both firms use pricing algorithms consisting of a parameterized family of model specifications. The firms update both the parameters and the weights on models to adapt endogenously to market outcomes. We show that the market experiences recurrent episodes where both firms set prices at collusive levels. We analytically characterize the dynamics of the model, using large deviation theory to explain the recurrent episodes of collusive outcomes. Our results show that collusive outcomes may be a recurrent feature of algorithmic environments with complementarities and endogenous adaptation, providing a challenge for competition policy.

[June. 11, 2024] Yu Awaya (University of Rochester)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/6/11 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

[June. 18, 2024] Yukio KORIYAMA (Ecole Polytechnique)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/6/18 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

[June. 25, 2024] Parag Pathak (The Massachusetts Institute of Technology)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/6/25 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

[July. 2, 2024] Ryuji SANO (Yokohama National University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/7/2 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

[July. 9, 2024] Norio TAKEOKA (Hitotsubashi University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/7/9 (Tue) 10:25-12:10

Title: “Optimal Ambiguity Perception”

Abstract: TBA

[July. 16, 2024] Daisuke Hirata (Hitotsubashi University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/7/16 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

[Oct. 1, 2024] Bumin Yenmez (Washington University in St. Louis)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/10/1 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

[Oct. 8, 2024] Wojciech Olszewski (Northwestern University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/10/8 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

[Oct. 15, 2024] Jaeok Park (Yonsei University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/10/15 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

[Oct. 22, 2024] Takuo Sugaya (Stanford University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/10/22 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

[Nov. 5, 2024] Taro KUMANO (Yokohama National University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/11/5 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

Past Workshops

[Apr. 16, 2024] Kenzo Imamura (University of Tokyo)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/4/16 (Tue) 10:25-12:10

Title: “Strategy-proofness and competitive equilibrium with transferable utility: Gross substitutes revisited” Keisuke Bando, Kenzo Imamura, Tomoya Kazumura

Abstract: We study the strategy-proofness (SP) of the competitive equilibrium selection (CE) mechanism in many-to-one matching with continuous transfers and quasilinear utility. The gross substitutes condition is known to guarantee the existence of CE and SP mechanisms. We show the converse: If a CE and SP mechanism exists, then the valuation of each firm must satisfy the gross substitutes condition. Various conditions for the existence of competitive equilibria have been proposed in the literature. Our results suggest that only the gross substitutes condition guarantees the existence of CE and SP mechanisms. We provide additional implications of our results for investment incentives and policy design. We also examine the two other models—the one with non-quasilinear utility and the one with discrete transfers. In contrast, the gross substitutes condition is not necessary in either model.

[Apr. 9, 2024] Mamoru Kaneko (University of Tsukuba and Waseda University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/4/9 (Tue) 10:25-12:10

Title: “Conceptual Analysis of the Centipede Paradox and its Practical Resolution” by Mamoru Kaneko & Ryuichiro Ishikawa

Abstract: We start to identify the centipede paradox as the antagonism between the BI (backward induction) outcome in a centipede game and people’s responses that Selten indicated for the chain-store paradox. We explore the underlying postulates for the centipede paradox as well as a centipede game. Based on them, we weaken the BI theory so that payoffs are possibly incomparable for a player depending upon his bounded cognitive ability. In this case, he is assumed to follow inertial behavior when decision nodes have some distance from the start. In the CIB (conscious choice/inertial behavior) theory which we develop, when both players have high cognitive abilities, the CIB theory exhibits the same outcome as the BI theory, but when at least one has a low ability, it induces quite opposite outcomes to go to the ending area of the game. We argue that these results are compatible with the postulate for a centipede game leading to cooperation, which is the reason for with people’s responses indicated by Selten. These considerations form a resolution of the centipede paradox.

[April 2, 2024] Yuichi Yamamoto (Hitotsubashi University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/4/2 (Tue) 10:25-12:10

Title: “Unawareness and Equilibrium Stability” with Takeshi Murooka

Abstract: This paper considers a Bayesian learning problem where strategic players jointly learn an unknown economic state $\theta$, and show that one’s unawareness about the opponent’s overconfidence can have a significant impact on the equilibrium outcome. We consider a simple environmental problem where players’ production, as well as an unknown state $\theta$, affects the quality of the environment. Crucially, we assume that one of the players is unrealistically optimistic about the quality of the environment. When this optimism is common knowledge, the equilibrium outcome is continuous in the amount of optimism, and hence small optimism leads to approximately correct learning of the state $\theta$. In contrast, when the optimism is not common knowledge and each player is unaware of the opponent having a different view about the world, the equilibrium outcome is discontinuous, and even vanishingly small optimism leads to completely incorrect learning. We then analyze a general Bayesian learning model and discuss when such discontinuity arises.

[March 7, 2024] Mitsuru Igami (伊神 満) (Yale University, Yale Department of Economics)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/3/7 (Thu) 10:25-12:10

Title: “Welfare Gains from LCD Innovations, 2001–2011” with Shoki Kusaka, Jeff Qiu, Tuyetanh L. Tran

Abstract: We assess the welfare impact of new technologies by using detailed data from theglobal industry of liquid crystal display (LCD) panels. We focus on measuring bothproductivity growth via process innovation and consumer benefits from new products.We find process innovation accounted for most of the welfare gains in the computersegment, whereas product innovation played a major role in the TV segment. Wefurther decompose process innovation into vintage capital and learning by doing, andproduct innovation into larger products and other new varieties. We then conduct aseries of benefit-cost analyses to quantify the social and private returns on technologicalinvestments. Results suggest social returns were large, but most firms’ private returnswere small or negative; competitive pressure forced them to invest nevertheless.

[March 5, 2024] Leon Musolff(Wharton, University of Pennsylvania)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/3/5 (Tue) 10:25-12:10

Title: “Entry Into Two-Sided Markets Shaped By Platform-Guided Search” with Kwok Hao Lee

Abstract: Consider firms that operate platforms matching buyers and sellers while selling goods themselves. By guiding consumers towards their own products through algorithmic recommendations, these firms could influence market outcomes – a regulatory concern. To investigate, we combine novel data about sales and recommendations on Amazon with a structural model that captures seller entry. Recommendations are highly price-elastic (-20), and many consumers (34%) only consider recommended offers. Hence, algorithmic recommendations raise the demand elasticity (from -8 to -11), intensify price competition, and increase the purchase rate. However, increased competition reduces entry (but the missing merchants are the least efficient). Focusing on self-preferencing: recommendations favor Amazon (equivalent to a 6% price discount), but this skew does not act as a barrier to entry or otherwise harm consumers. Indeed, since consumers prefer Amazon’s offers, “self-preferencing” slightly raises consumer surplus by $9 per product per month (assuming Amazon’s prices remain constant.)

[Feb. 6, 2024] Harry Pei (Northwestern University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2024/2/6 (Tue) 10:25-12:10

Title: Community Enforcement with Endogenous Records

Abstract: I study repeated games with anonymous random matching and a continuum of players. By the end of each period, each player can erase the signal generated in that period from his record. I show that when players are sufficiently long-lived and have strictly dominant actions in the stage game, they will play their dominant actions with probability arbitrarily close to one in all equilibria. When players’ expected lifespans are intermediate, there exist purifiable equilibria with a positive level of cooperation in the submodular prisoner’s dilemma but not in the supermodular prisoner’s dilemma. My results suggest that when players can selectively include signals in their records, the maximal level of cooperation a community can sustain is not monotone with respect to the expected lifespans of its members and that the complementarity in players’ actions can undermine their abilities to sustain cooperation.

[Dec. 19, 2023] Sangyoon Park (HKUST)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/12/19 (Tue) 10:25-12:10

Title: “Education and Wartime Mobilization: Evidence from Colonial Korea during WWII”

Abstract: We empirically examine the effect of colonial education on the mobilization of Koreans during World War II. In the early 1920s, the Japanese colonial government implemented an education expansion policy that doubled the number of public primary schools for Koreans. We employ a difference-in-differences strategy which exploits cross-regional variation in the number of schools built under this policy and cross-cohort variation in the exposure to school expansion. Our estimate suggests that the expansion of public primary education significantly increased military mobilization. The results are robust to a number of controls that account for potential confounders. By exploiting the design of the expansion policy, we use an instrumental variable approach and show that the results are qualitatively unchanged. We examine several potential mechanisms that explain our finding.

[Dec. 5, 2023] Kota Saito(California Institute of Technology)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/12/5 (Tue) 10:25-12:10

Title: “Axiomatization of Random Utility Model with Unobservable Alternatives” with Haruki Kono, Alec Sandroni

Abstract: The random utility model is one of the most fundamental models in economics. Falmagne (1978) provides an axiomatization but his axioms can be applied only when choice frequencies of all alternatives from all subsets are observable. In reality, however, it is often the case that we do not observe choice frequencies of some alternatives. For such a dataset, we obtain a finite system of linear inequalities that is necessary and sufficient for the dataset to be rationalized by a random utility model. Moreover, the necessary and sufficient condition is tight in the sense that none of the inequalities is implied by the other inequalities, and dropping any one of the inequalities makes the condition not sufficient.

[Nov. 28, 2023] Jiangtao Li (Singapore Management University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/11/28 (Tue) 10:25-12:10

Title: “Undominated Mechanisms” with Tilman Börgers, Kexin Wang

Abstract: A mechanism is dominated by another mechanism if the latter mechanism generates a weakly higher ex post revenue for all valuation profiles and a strictly higher ex post revenue for at least one valuation profile. A mechanism is undominated if there is no mechanism that dominates it. We study the class of undominated mechanisms in various environments.

[Nov. 21, 2023] Ashutosh Thakur (National University of Singapore)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/11/21 (Tue) 10:25-12:10

Title: Evolution of Institutional Designs: Theory and Empirics

Abstract: In many organizations, members need to be assigned to certain positions, whether these are legislators to committees, executives to roles, or workers to teams. In such settings, the design of the assignment procedure becomes an institutional choice that is influenced and agreed upon by the very members being assigned. Will these agents seek to reform the assignment procedures by voting in favor of some alternative allocation over their current allocation? I explore this question of institutional stability by bringing together matching theory and social choice. I introduce majority stability—i.e., institutional stability under majority rule—and juxtapose it with other voting rules an organization might use to resolve internal conflict. Institutional stability is undermined by correlation across agents’ preferences over positions, as the resulting envy enables a decisive coalition to arise endogenously to change the institution. For extremely correlated preferences, I establish a Chaos Theorem wherein there exists a majority-approved agenda from any matching allocation to any other allocation. Nevertheless, I show that institutions are robust to intermediate correlation across preferences under majority rule, in sharp contrast to plurality rule (i.e., popular matching, studied in computer science). Given the prevalence of (super-)majority rules in practice, this suggests why we observe institutional stability.

[Nov. 14, 2023] Stefano Lovo (HEC Paris)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/11/14 (Tue) 10:25-12:10

Title: “Algorithmic Pricing and Liquidity in Securities Markets” (With J.E. Colliard and T. Foucault)

Abstract: We let “Algorithmic Market-Makers” (AMs), using Q-learning algorithms, choose prices for a risky asset when their clients are privately informed about the asset payoff. We find that AMs learn to cope with adverse selection and to update their prices after observing trades, as predicted by economic theory. However, in contrast to theory, AMs charge a mark-up over the competitive price, which declines with the number of AMs. Interestingly, markups tend to decrease with AMs’ exposure to adverse selection. Accordingly, the sensitivity of quotes to trades is stronger than that predicted by theory and AMs’ quotes become less competitive over time as asymmetric information declines.

[Nov. 7, 2023] David Neumark (University of California, Irvine)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/11/7 (Tue) 10:25-12:10

Title: “Help Really Wanted? The Impact of Age Stereotypes in Job Ads on Applications from Older Workers” with Ian Burn, Daniel Firoozi, Daniel Ladd

Abstract: Correspondence studies have found evidence of age discrimination in callback rates for older workers, but less is known about whether job advertisements can themselves shape the age composition of the applicant pool. We construct job ads for administrative assistant, retail, and security guard jobs, using language from real job ads collected in a prior large-scale correspondence study (Neumark et al., 2019a). We modify the job-ad language to randomly vary whether the job ad includes ageist language regarding age-related stereotypes. Our main analysis relies on computational linguistics/machine learning methods to design job ads based on the semantic similarity between phrases in job ads and age-related stereotypes. In contrast to a correspondence study in which job searchers are artificial and researchers study the responses of real employers, in our research the job ads are artificial and we study the responses of real job searchers.

We find that job-ad language related to ageist stereotypes, even when the language is not blatantly or specifically age-related, deters older workers from applying for jobs. The change in the age distribution of applicants is large, with significant declines in the average and median age, the 75 th percentile of the age distribution, and the share of applicants over 40. Based on these estimates and those from the correspondence study, and the fact that we use real-world ageist job-ad language, we conclude that job-ad language that deters older workers from applying for jobs can have roughly as large an impact on hiring of older workers as direct age discrimination in hiring.

[Nov. 1, 2023] Mirabelle Muûls (Imperial College London)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/11/1 (Wed) 10:25-12:10

Title: Does Pricing Carbon Mitigate Climate Change? Firm-Level Evidence from the European Union Emissions Trading Scheme” with Jonathan Colmer, Ralf Martin, Ulrich J. Wagner

Abstract: In theory, market-based regulatory instruments correct market failures at least cost. However, evidence on their efficacy remains scarce. Using administrative data, we estimate that, on average, the EU ETS – the world’s first and largest market-based climate policy – induced regulated manufacturing firms to reduce carbon dioxide emissions by 14-16% with no detectable contractions in economic activity. We find no evidence of outsourcing to unregulated firms or markets; instead firms made targeted investments, reducing the emissions intensity of production. These results indicate that the EU ETS induced global emissions reductions, a necessary and sufficient condition for mitigating climate change. We show that the absence of any negative economic effects can be rationalized in a model where pricing the externality induces firms to make fixed-cost investments in energy-saving capital that reduce marginal variable costs.

[Oct. 24, 2023] Philip Haile (Yale University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/10/24 (Tue) 10:25-12:10

Title: “Voting in Two-Party Elections: An Exploration Using Multi-Level Data” with Steve Berry and Christian Cox

[Oct. 17, 2023] Takuro Yamashita(Osaka University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/10/17 (Tue) 10:25-12:10

Title: 2023/10/17 (Tue) 10:25-12:10

Abstract: We study mechanism design with limited commitment. In each period, a principal offers a “spot” contract to a privately informed agent without committing to future contracts. In contrast to the classical model with a fixed information structure, we allow for all admissible information structures. We represent the information structure as a fictitious mediator and re-interpret the model as a mechanism design problem for the committed mediator. We construct examples to explain why new equilibrium outcomes can arise when considering general information structures. Next, we apply our approach to durable-good monopoly. In the seller-optimal mechanism, trade dynamics and welfare substantially differ from those in the classical model: the seller offers a discount to the high-valuation buyer in the initial period, followed by the high surplus-extracting price until an endogenous deadline, when the buyer’s information is revealed without noise. The Coase conjecture fails. We also discuss unmediated implementation of the seller-optimal outcome.

[Oct. 10, 2023] Sam Jindani (National University of Singapore)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/10/10 (Tue) 10:25-12:10

Title: The dynamics of costly social norms

Abstract: Social norms that are costly for individuals can remain in place for a long time because of social pressure to conform. Examples include duelling, footbinding, female genital cutting, and norms of conspicuous consumption. These and other costly norms are rarely “all-or-nothing”; instead, they take on many alternative forms. We develop a theory of norm dynamics that allows for such intermediate forms. The theory predicts rich dynamics that are consistent with cases where norm shifts have been documented.

[July 18, 2023] Chihiro Morooka (Tokyo Denki University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/7/18 (Tue) 10:25-12:10

Title: Characterizing the Feasible Payoff Set of OLG Repeated Games (with Daehyun Kim (Pohang University of Science and Technology, South Korea))

Abstract: We study the set of feasible payoffs of OLG repeated games. We first provide a complete characterization of the feasible payoffs. Second, we provide a novel comparative statics of the feasible payoff set with respect to players’ discount factor and the length of interaction. Perhaps surprisingly, the feasible payoff set becomes smaller as the players’ discount factor approaches to one.

[July 11, 2023] Dong Wei (University of California, Santa Cruz)

Date & Time: 2023/7/11 (Tue) 10:25-12:10

Title: Turning the Ratchet: Dynamic Screening with Multiple Agents

Abstract: We study a dynamic contracting problem with multiple agents and a lack of commitment. A principal who can only commit to one-period contracts would like to screen efficient (i.e., low-cost) workers over time and assign harder tasks to them. After efficiency is revealed, the principal becomes tempted to change the terms of trade. Breaches in contracts are observable and, hence, whenever past promises are not honored future information revelation stops. We provide necessary and sufficient conditions under which the principal is able to foster information revelation. Optimal contracts entail high-powered incentives after information is initially revealed, and rewards for information revelation disappear in the long run. Information revelation becomes easier when workers are stochastically replaced by new ones.

[June 28, 2023] Megumi Murakami (Northwestern University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 3 on the 2nd floor of the Kojima Hall

Date & Time: 2023/6/28 (Wed) 13:15-14:45

Title: Demand and Supply of Medical Knowledge in the Market

Abstract: This research aims to investigate what factors contributed to the slower development of medicine in comparison to other sciences, and, what were the conditions for a new medical scientific theory to gain acceptance in society. Medical science differs from other natural sciences in that non-experts play a crucial role in the adoption of new theories. To illustrate this point, three historical cases are presented: scurvy in the British Navy, the 1982 cholera outbreak in Hamburg, and the anti-smallpox vaccination movements. We construct a signaling game with multiple senders and receivers, taking into account the medical market and the role of non-experts. We use Perfect Bayesian Nash equilibrium (PBNE), focusing on two pure strategies : the truth-telling strategy and the conforming strategy. The cause of hindering the spread of correct knowledge varies depending on the equilibrium. In the truth-telling PBNE, the spread of correct knowledge is delayed because experts may propose incorrect theories due to receiving wrong information. In the partial conforming PBNE, the main cause is that pseudo-experts who express opposing opinions are more favored than experts who express correct scientific opinions. The modified model examines the scenario where experts can discuss new theories without persuading the general public, which is observed in natural sciences. We show that the condition for the existence of the truth-telling PBNE in medical science is more stringent than in natural science.

[June 27, 2023] Ming Li (Concordia University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/6/27 (Tue) 10:25-12:10

Title: Mandatory disclosure of conflicts of interest: Good news or bad news? (Coauthor: LIU, Ting (Stony Brook University))

Abstract: We investigate the welfare effect of disclosure of conflict of interest when an expert advises a decision maker. In a model with verifiable information and uncertainty about the expert’s conflict of interest and the informedness of the expert, we show that disclosure of the expert’s bias is counterproductive when the magnitude of the expert’s bias is small and the likelihood of the expert being informed is low. The welfare loss is due to the distortion of the decision maker’s action when the expert proclaims no information.

[June 20, 2023] David Dillenberger (University of Pennsylvania)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/6/20 (Tue) 10:25-12:10

Title: Caution and reference effects

Abstract: We introduce Cautious Utility, a new model based on the idea that individuals are unsure of trade-offs between goods and apply caution. The model yields an endowment effect, even when gains and losses are treated symmetrically. Moreover, it implies either loss aversion or loss neutrality for risk, but in a way unrelated to the endowment effect, and it captures the certainty effect, providing a novel unified explanation of all three phenomena. Finally, Cautious Utility can help organize empirical evidence, including some that directly contradict leading alternatives.

[June 19, 2023] Allen Vong (University of Macau)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/6/19 (Mon) 10:25-12:10

Title: Effort smoothing

Abstract: This paper highlights a new role of mediation in addressing dynamic moral hazard. I study a mediated market in which a worker repeatedly supplies costly effort. Equilibrium social welfare is maximized if and only if the mediator facilitates the worker’s occasional and secret shirking at the expense of her employers.

[June 13, 2023] Makiko Nakamuro (Keio University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/6/13 (Tue) 10:25-12:10

Title: The effect of the quality of early childhood education on children’s subsequent outcomes

Abstract: This study presents the first quantitative evaluation of the quality of early childhood education and care (ECEC) in Japan to make a significant contribution to the body of knowledge accumulated on ECEC in countries where research has been limited. We observed 30 classes comprising 3-year-olds, 28 classes comprising 5-year-olds, and 30 classes comprising mixed-ages from publicly provided nursery centers under the jurisdiction of the Kanto metropolitan area, Japan. An internationally-recognized quality rating scale for ECEC called the Early Childhood Environment Rating Scale, 3rd edition, which consists of six subscales, was used for this study. In contrast to previous studies conducted in the US, the results of this study showed that the Japanese ECEC is characterized as showing higher scores in the two subscales, “Personal Care Routines” and “Interaction,” and showing lower score in the subscale, “Learning Activities.” In addition, this study showed that the quality of ECEC varied across nursery centers. Furthermore, with regard to the two subscales, “Interaction” and “Language and Literacy,” the degree of variation within centers differed across nursery centers. This study analyzed how these characteristics of Japanese ECEC can be partly produced by the existence of national guideline for nursery centers authorized by the Japanese government. In addition, mechanisms producing differences in the quality of ECEC among and within centers were also discussed.

[June 12, 2023] Wooyoung Lim (The Hong Kong University of Science and Technology)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/6/12 (Mon) 13:00-14:45

Title: Lying and Deception in Repeated Communication (joint with Syngjoo Choi (SNU) and Chanjoo Lee (SNU))

Abstract: Lying and deception are common in economic interactions and have important strategic implications. While related, they are distinct phenomena that may have different effects on communication outcomes. In this paper, we study repeated communication with a reputation concern in a two-dimensional belief domain, and identify two environments where lying and deception are completely separated. In one environment, the sender must tell the truth to conceal a bad intention, while in the other, the sender must lie to reveal a good intention. Our experimental data show that the proportion of senders who successfully build reputations is lower than predicted in both environments. Furthermore, the deviation from theory is greater when reputation-building requires lying rather than deception. Finally, we observe that receivers punish senders for lying, even when the intention behind it is good. Our findings suggest that different communication mechanisms may perform differently depending on their reliance on lying or deception, highlighting the need to distinguish between these two concepts investigating organizational and political phenomena.

[June 6, 2023] Dean Hyslop (Motu Economic and Public Policy Research)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/6/6 (Tue) 10:25-12:10

Title: Training, Productivity and Wages: Direct evidence from a Temporary Help Agency (joint with Xinwei Dong and Daiji Kawaguchi)

Abstract: Firms frequently provide general skill training to workers at the firm’s cost. Theories proposed that labor market frictions entail wage compression, larger productivity gain than wage growth to skill acquisition, and motivates a firm to offer general skill training, but few studies directly test them. We use unusually rich data from a temporary help service firm that records both workers’ wages and their productivity as measured by the fees charged to client firms. We find evidence that skill acquired through training and learning-by-doing increases productivity more than wages, which is consistent with wage compression.

[May 16, 2023] Shigehiro Serizawa (Osaka University of Economics)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/5/16 (Tue) 10:25-12:10

Title: Minimum price equilibrium in the assignment market: The Serial Vickrey mechanism

Abstract: We study an assignment market where multiple heterogenous objects are sold to unit demand agents who have general preferences that accommodate income effects and market frictions. The minimum price equilibrium (MPE) is one of the most important equilibrium notions in such settings. Nevertheless, none of the well-known mechanisms that find the MPEs in the quasi-linear environment can identify or even approximate the MPEs for general preferences. We establish novel structural characterizations of MPEs and design the “Serial Vickrey (SV) mechanism” based on the characterizations. The SV mechanism finds an MPE for general preferences in a finite number of steps. Moreover, the SV mechanism only requires agents to report finite-dimensional prices in finitely many times, and also has nice dynamic incentive properties.

[May 9, 2023] Norio Takeoka(Hitotsubashi University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/5/9 (Tue) 10:25-12:10

Title: Coarse Information Acquisition

Abstract: If agents are not given sufficient information when making decisions, they will attempt to obtain more accurate information through information acquisition. The literature of rational inattention hypothesizes that a rational agent optimally chooses an experiment or information structure to obtain an additional piece of information. In reality, however, it is difficult to conduct accurate experiments due to lack of knowledge about the experiment itself and/or ambiguity about the payoff-relevant state space. This paper studies the choice behavior of decision makers who are aware that their information acquisition is not always accurate and that they can only choose coarse experiments. By adopting the choice theoretic model of information acquisition, provided in de Oliveira, Denti, Mihm, and Ozbek [12], we argue that one of their axioms, which is interpreted as preference for early resolution of risk and takes a form of quasi-convexity of preference, excludes the possibility of coarse experiments. By relaxing their quasi-convexity axiom, we axiomatically characterize models of information acquisition with coarse experiments.

[Apr. 25, 2023] Pavel Kireyev (INSEAD)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/4/18 (Tue) 10:25-12:10

Title: NFT Marketplace Design and Market Intelligence

Abstract: Nonfungible tokens (NFTs) have exploded in popularity in 2021, generating billions of dollars in transaction volume. In tandem, market intelligence platforms have emerged to track summary statistics about pricing and sales activity across different NFT collections. We demonstrate that marketplace design can significantly influence market intelligence, focusing specifically on the costs of bidding which can differ across marketplaces depending on transaction fees, the prevalence of bidding bots, or the user interface for placing bids. We use data from the CryptoPunks marketplace and build an empirical model of the strategic interaction between sellers and bidders. Counterfactual simulations show that a reduction in bidding costs does not change the quantity of sales, but increases the share of sales that result from bids. Listing prices increase as sellers expect to accept more bids, making assets appear more valuable. The listing and realized sale price ratios between rare and common assets shrink, making the market appear more homogeneous. Collections that are offered by two different marketplaces can exhibit significantly different market statistics because of differences in bidding costs rather than differences in inherent value. The results have implications for the interpretation of NFT market intelligence.

Cancelled [Apr. 24, 2023] Richard Holden (University of New South Wales)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/4/24 (Mon) 10:25-12:10

Title: Coordination in Supply Chains (joint with Robert Akerlof)

Abstract: Many complex final goods require a large number of inputs to come together in a timely and efficient manner for production to be successful. Notable examples include lithography machines used to make semiconductors, airplanes, and lasers. We build a model to analyze this coordination problem and show how coordination can be achieved. There is a manufacturer endowed with capital who needs an input from each of n suppliers to produce a final good. The manufacturer may pay a markup to overcome supplier reluctance and achieve coordination. Coordination can also be achieved through integration, but integration inflates costs due to a lack of congruence between manufacturer and supplier. We model integration and the associated cost inflation along the lines of Aghion-Tirole (1997). We derive sharp predictions about firm structure and apply our model to a number of applications including International Trade and Industry Policy.

[Apr. 18, 2023] Daniele Condorelli (University of Warwick)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/4/18 (Tue) 10:25-12:10

Title: Buyer-Optimal Platform Design

Abstract: A platform matches a unit-mass of sellers, each owning a single product of heterogeneous quality, to a unit-mass of buyers with differing valuations for unit-quality. After matching, sellers make take- it-or-leave-it price-offers to buyers. Initially, valuations of buyers are only known to them and the platform, but sellers make inferences from the matching algorithm. The efficient matching is positive- assortative, but buyer-optimal matchings are, often, stochastically negative-assortative (i.e., compared to lower-quality sellers, high-quality ones are matched to buyers with lower expected valuation). Al- beit everyone trades when the platform has full-information, generating rents for the side lacking bargaining power results in inefficient matching.

[Apr. 12, 2023] Bruno Strulovici (Northwestern University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Title: Robust Implementation with Costly Information

Abstract: We design mechanisms that robustly implement any desired social choice function when (i) agents must incur a cost to learn the state of the world, (ii) with small probability, agents’ pref- erences can be arbitrarily different from some baseline known to the social planner, and (iii) the planner does not know agents’ beliefs and higher-order beliefs about one another’s preferences. The mechanisms we propose have a natural interpretation, and are robust to trembles in agents’ reporting strategies, to the introduction of a small amount of noise affecting agents’ signals about the state, and to uncertainty concerning the state distribution and agents’ prior beliefs about the state. We also establish impossibility results for stronger notions of robust implementation.

[Apr. 11, 2023] Nikhil Agarwal (Massachusetts Institute of Technology)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/4/11 (Tue) 10:25-12:10

Title: Combining Human Expertise with Artificial Intelligence: Experimental Evidence from Radiology

Abstract: Artificial intelligence (AI) algorithms have matched or surpassed the performance of human experts in a number of predictive tasks, although human experts have access to contextual information that may not be available for machine predictions. We investigate how best to combine machine predictions with human input in the presence of such contextual information and potential biases in how humans use machine predictions in forming their assessments. Our experiment varies the availability of AI support and contextual information. We find that that contextual information improves diagnostic accuracy on average, but providing AI predictions does not always increase accuracy although there are large potential gains from having radiologists make decisions using AI support. These gains are not realized because radiologists partially neglect the AI’s information and do not account for the redunancy between their own information and the AI’s information. An implication of our results is that, unless these mistakes can be corrected, the design of an optimal collaborative system has radiologists work alongside as opposed to with AI.

[Mar. 28, 2023] Bobak Pakzad-Hurson (Brown University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2023/3/28 (Tue) 10:25-12:10

Title: Do Peer Preferences Matter in School Choice Market Design? Theory and Evidence (joint with Natalie Cox, Ricardo Fonseca, and Matthew Pecenco)

Abstract: Can a school-choice clearinghouse generate a stable matching if it does not allow students to express preferences over peers? Theoretically, we show stable matchings exist with peer preferences under mild conditions but finding one via canonical mechanisms is unlikely. Increasing transparency about the previous cohort’s matching induces a tâtonnement process wherein prior matchings function as prices. We develop a test for stability and implement it empirically in the college admissions market in New South Wales, Australia. We find evidence of preferences over relative peer ability, but no convergence to stability. We propose a mechanism improving upon the current assignment process.

[Dec. 27, 2022] Yuta Toyama (Waseda University)

- This seminar is held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2022/12/27 (Tue) 10:25-12:10

Title: Welfare Effects of Nonlinear Electricity Pricing with Misperception: A Case of Free Electricity Policy (joint with Ngawang Dendup)

Abstract: This paper evaluates the welfare effects of nonlinear electricity pricing when consumers may have a misperception about the pricing schedule. We focus on a unique electricity subsidy program in Bhutan where electricity is provided for free up to 100 kWh per month. Using administrative billing data from the universe of retail customers, we find a distinctive bunching of consumption at 100 kWh after the introduction of the program. To interpret this observation and derive welfare implications of the policy, we construct and estimate a model of electricity demand for consumers with different types of misperceptions. We identify the composition of consumer types by exploiting the differential behavior of each type near the threshold and the variation of tariff schedule across regions and over time. We then conduct a simulation analysis to evaluate the free electricity policy. The current subsidy scheme benefits households with higher electricity consumption. The welfare loss due to the misperception is about 1%-5% of monthly electricity expenditure. Finally, we investigate the optimal tariff schedule and its welfare and distributional implications.

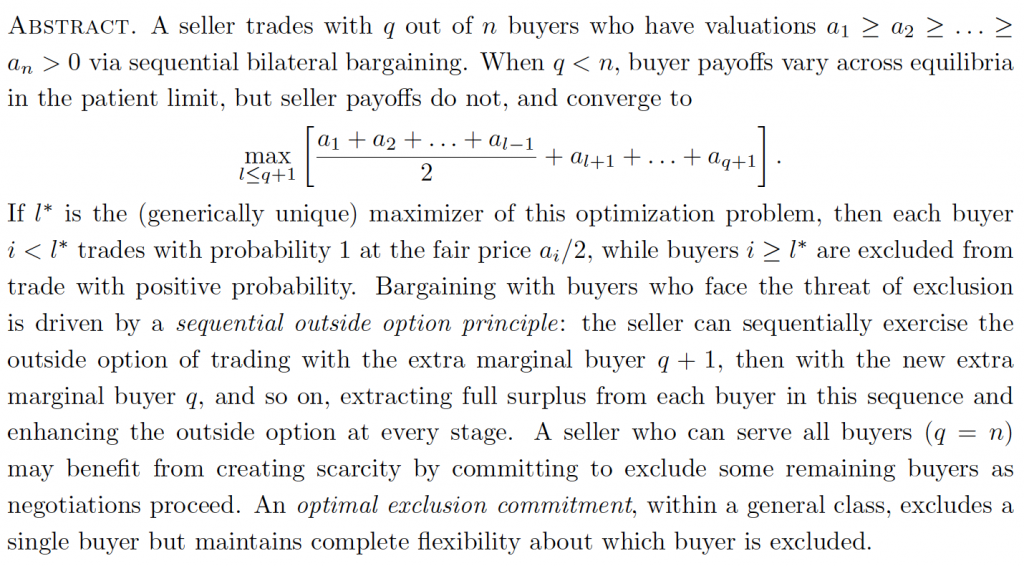

[Dec. 19, 2022] Mihai Manea (Stony Brook University)

- This seminar iss held in-person and online.

venue (in-person): Seminar Room 2 on the 1st floor of the Kojima Hall

Date & Time: 2022/12/19 (Mon) 10:30-12:00

Title: Bargaining and Exclusion with Multiple Buyers (with Dilip Abreu)

[Dec. 13, 2022] William Fuchs (The University of Texas at Austin McCombs School of Business and Universidad Carlos III)

- This seminar was held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2022/12/13 (Tue) 10:25-12:10

Title: Time Trumps Quantity in the Market for Lemons

Abstract: We consider a dynamic adverse selection model where privately informed sellers of divisible assets can choose how much of their asset to sell at each point in time to competitive buyers. With commitment, delay and lower quantities are equivalent ways to signal higher quality. Only the discounted quantity traded is pinned down in equilibrium. With spot contracts and observable past trades, there is a unique and fully separating path of trades in equilibrium. Irrespective of the horizon and the frequency of trades, the same welfare is attained by each seller type as in the commitment case. When trades can take place continuously over time, each type trades all of its assets at a unique point in time. Thus, only delay is used to signal higher quality. When past trades are not observable, the equilibrium only coincides with the one with public histories when trading can take place continuously over time.

[Dec. 12, 2022] Kota Saito (California Institute of Technology)

- This seminar was held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2022/12/12 (Mon) 10:25-12:10

Title: Approximating Choice Data by Discrete Choice Models

Abstract: We obtain a necessary and sufficient condition under which random-coefficient discrete choice models such as the mixed logit models are rich enough to approximate any nonparametric random utility models across choice sets. The condition turns out to be very simple and tractable. When the condition is not satisfied and, hence, there exists a random utility model that cannot be approximated by any random-coefficient discrete choice model, we provide algorithms to measure the approximation errors. After applying our theoretical results and the algorithms to real data, we find that the approximation errors can be large in practice.

[Dec. 2, 2022] Shoya Ishimaru (Hitotsubashi University)

- This seminar was held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2022/12/2 (Fri) 10:25-12:10

Title: Geographic Mobility of Youth and Spatial Gaps inLocal College and Labor Market Opportunities

Abstract: This paper examines the importance of college and labor market opportunities for thecausal link between childhood locations and adulthood economic outcomes. I develop andestimate a dynamic model of individual choice of whether and where to attend college andwhere to work, accounting for home preferences, spatial search friction, and moving costs. Theestimated model suggests that substantial gaps in college attendance rates and the expectedwages among children from different counties in the US would arise from imperfect mobility incollege and locational decisions, even in the absence of spatial gaps in family background andchildhood neighborhood quality.

[Nov. 8, 2022] Susumu Sato (Hitotsubashi University)

- This seminar was held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2022/11/8 (Tue) 10:25-12:10

Title: Competition in Two-Sided Markets: an Aggregative-Games Approach

Abstract: This article develops an aggregative-games framework for studying asymmetric platform oligopoly in two-sided markets. Using a model of platform choice that has a unique stable consumption equilibrium, I derive an IIA demand system for two-sided platforms that generalizes multinomial logit models. Then, I represent platform competition as an aggregative game and apply it to three competition analyses: platform dominance, platform mergers, and long-run equilibrium with fringe entry. The dominance of a large platform is associated with a higher consumer surplus on one side only when the consumers benefit from both network effects and two-sided pricing. The merger analysis demonstrates that network effects serve as a synergy but also make large mergers harmful to consumers, and the pre-merger price structure provides useful information on the effects of two-sided pricing. In an equilibrium with fringe entry, any change in competitive environments that benefits consumers on one side hurts consumers on the other side.

[Nov. 1, 2022] Hiroko Okudaira (Doshisha University)

- This seminar was held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2022/11/1 (Tue) 10:25-12:10

Title: Parental Investment after Adverse Event: Evidence from the Great East Japan Earthquake

Abstract: Parents often increase private investment in their children when they fear the negative effects of an adverse event. However, such an endogenous response makes it difficult to identify the cost of the adverse event and those disadvantaged by the shock. This study investigates the nature of an adverse shock that leads to endogenous responses by parents. Relying on the types of damage caused by the Great East Japan Earthquake, we find that parents exposed to intense ground motion increased their investment in children’s cognitive skills. This positive response survives or becomes even larger after accounting for physical destruction and radioactive contamination.

[Oct. 25, 2022] Makoto Yokoo (Kyushu University)

- This seminar was held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2022/10/25 (Tue) 10:25-12:10

Title: Matching Market Design with Constraints

Abstract: Two-sided matching deals with finding a desirable combination of two parties, e.g., students and colleges, workers and companies, and medical residents to hospitals. Beautiful theoretical results on two-sided matching have been obtained, i.e., the celebrated Deferred Acceptance mechanism is strategyproof for students, and obtains the student optimal matching among all stable matchings. However, these results are applicable only for the standard model, where only distributional constraints are the maximum quota (capacity limit) of each college. In many real application domains, various distributional constraints are imposed due to social requirements. For example, a college needs a certain number of students to operate, or some medical residents must be assigned to a rural hospital.

In this talk, I represent a simple and general abstract model, and introduce a few representative constraints that can be formalized using this model. In this model, distributional constraints are defined over a set of allocation vectors, each of which describes the number of students allocated to each college. Then, I present two general mechanisms. One is the generalized DA, which works when distributional constraints satisfy two conditions: hereditary and an M-natural-convex set [1]. More specifically, the generalized DA is strategyproof, and finds the student optimal matching among all matchings that satisfy some stability requirement. The other is the adaptive DA [2], which works when distributional constraints satisfy hereditary condition. It is strategyproof and nonwasteful.

[1] Kojima, F., Tamura, A., Yokoo, M.: Designing matching mechanisms under constraints: An approach from discrete convex analysis, Journal of Economic Theory, 176 (2018)

[2] Goto, M., Kurata, R., Kojima, F., Kurata, R., Tamura, A, Yokoo, M.: Designing Matching Mechanisms under General Distributional Constraints, American Economic Journal: Microeconomics, 9 (2):226-62, (2017).

[Oct. 18, 2022] Aniko Öry (Yale School of Management)

- This seminar was held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2022/10/18 (Tue) 10:25-12:10

Title: Dynamic Price Competition: Theory and Empirical Evidence From Airline Markets

Abstract: We introduce a model of oligopoly dynamic pricing where firms with limited capacity face a sales deadline. We establish conditions under which the equilibrium is unique and converges to a system of differential quations. Using unique and comprehensive pricing and bookings data for competing U.S. airlines, we estimate our model and find that dynamic pricing results in higher output but lower welfare than under uniform pricing. Our theoretical and empirical findings run counter to standard results in single-firm settings due to the strategic role of competitor scarcity. Pricing heuristics commonly used by airlines increase welfare relative to estimated equilibrium predictions.

[Oct. 11, 2022] Daniel Quint (University of Wisconsin-Madison)

- This seminar was held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2022/10/11 (Tue) 10:25-12:10

Title: “Bid Shopping” in Procurement Auctions with Subcontracting

Abstract: We analyze the equilibrium effects of “bid shopping” – a contractor soliciting a subcontractor bid for part of a project prior to a procurement auction, then showing that bid to a competing subcontractor in an attempt to secure a lower price. Such conduct is widely criticized as unethical by professional organizations, and has been the target of legislation at both the federal and state level, but is widespread in procurement auctions in many places. Our baseline model suggests that bid shopping that brings in new subcontractors after the auction – rather than diverting some existing subcontractors to post-auction competition – always increases social surplus, benefitting the procurer at the expense of the existing subcontractors. Bid shopping that causes some subcontractors to wait to bid until after the auction tends to decease total surplus when subcontractors’ bid preparation costs are low, but may increase total surplus when bid preparation costs are high.

[Oct. 4, 2022] Yingni Guo (Northwestern University)

Date & Time: 2022/10/4 (Tue) 10:25-12:10

Title: Robust Monopoly Regulation

Abstract: We study the regulation of a monopolistic firm using a non-Bayesian approach. We derive the policy that minimizes the regulator’s worst-case regret, where regret is the difference between the regulator’s complete-information payoff and his realized payoff. When the regulator’s payoff is consumers’ surplus, he imposes a price cap. When his payoff is the total surplus of both consumers and the firm, he offers a capped piecerate subsidy. For intermediate cases, the regulator uses both a price cap and a capped piece-rate subsidy. The optimal policy balances three goals: giving more surplus to consumers, mitigating underproduction, and mitigating overproduction.

[July 26, 2022] Nina Bobkova (Rice University)

Date & Time: 2022/7/26 (Tue) 10:25-12:10

Title: Information Choice in Auctions

Abstract: The choice of an auction mechanism influences which object characteristics bidders learn about and whether the object is allocated efficiently. Some object characteristics are valued equally by all bidders and thus are inconsequential for the efficient allocation. Others matter only to certain bidders, and thus determine the bidder with the highest object value. I show that the efficient auction is the second-price auction: it induces bidders to learn exclusively about object characteristics which matter only to them. An independent private value framework arises endogenously.

[July 5, 2022] Michael Zierhut (Humboldt University)

- This seminar was held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2022/7/5 (Tue) 10:25-12:10

Title: Dynamic Inconsistency and Inefficiency of Equilibrium under Knightian Uncertainty

Abstract: This paper extends the theory of general equilibrium with Knightian uncertainty to economies with more than two dates. Agents have incomplete preferences with multiple priors `a la Bewley. These priors are updated in light of new information. Contrary to the two-date model, the market outcomes varies with choice of updating rule. We document two phenomena: First, unless agents apply the full Bayesian rule, consumption decisions may be dynamically inconsistent. Second, unless they apply the maximum-likelihood rule, ambiguous probability mass may dilate, which causes price fluctuations. Either phenomenon results in Pareto inefficient allocations. We ask whether it is possible to design one updating rule that prevent both phenomena. The answer is negative: No such rule exists. Efficiency can be restored by restricting priors: Full Bayesian and maximum-likelihood updates agree when priors are rectangular, and when ambiguity is sufficiently large, all equilibria are Pareto efficient, even if prices and allocations change over time.

[June 28, 2022] Michihiro Kandori (The University of Tokyo)

- This seminar was held in-person and online.

venue (in-person): Seminar Room 1 on the 1st floor of the Kojima Hall

Date & Time: 2022/6/28 (Tue) 10:25-12:10

Title: Machine Learning Approach to Uncover How Players Choose Mixed Strategies (joint work with T. Hirasawa and A. Matsushita)

Abstract: How do humans behave in a situation where (i) one needs to make one’s own behavior unpredictable and (ii) one needs to predict the opponent’s behavior? Such a situation can be formulated as a game with a mixed strategy equilibrium. If humans are put in such a situation, it should be obvious that, rather than calculating and following the mixed equilibrium, they use their intuition, hunch, and some heuristics to achieve the above-mentioned goals (i) and (ii). Exactly what kind of mechanisms are employed has not been fully understood. By using a unique big experimental data set we have collected about a game with mixed strategy equilibrium, which has more than 75,000 observations, we compare conventional behavior economics models and some leading machine learning models to uncover how human behavior is determined in such a situation. Our big data enabled us to obtain a reliable comparison of the prediction powers of those models, and we found that machine learning models, most notably a version of the deep learning model LSTM, substantially outperform the leading behavioral model (EWA). Finally, we try to improve the EWA model by incorporating the insights gained by the machine learning models.

[June 21, 2022] YingHua He (Rice University)

Date & Time: 2022/6/21 (Tue) 10:25-12:10

Title: Leveraging Uncertainties to Infer Preferences: Robust Analysis of School Choice (joint work with Yeon-Koo Che and Dong Woo Hahm)

Abstract: Recent evidence suggests that market participants make mistakes even in a strategically straightforward environment but seldom with significant payoff consequences. We explore the implications of such payoff-insignificant mistakes for inferring students’ preferences from school-choice data. Uncertainties arise from the use of lotteries or other sources in a typical school choice setting; they make certain mistakes more costly than others, thus making some preferences—those whose misrepresentation would be more costly and would thus be avoided by students—more reliably inferable than others. We propose a novel method of exploiting the structure of the uncertainties present in a matching environment to robustly infer student preferences under the Deferred-Acceptance mechanism. We then apply our methods to estimate student preferences through a Monte Carlo analysis capturing canonical school choice environments with single tie-breaking lotteries, and also to New York City’s high school assignment data. We then evaluate the effects of an affirmative action policy on disadvantaged and non-disadvantaged students.

[June 14, 2022] Hongyao Ma (Columbia Business School)

Date & Time: 2022/6/14 (Tue) 10:25-12:10

Title: Randomized FIFO Mechanisms (joint work with Francisco Castro, Hamid Nazerzadeh and Chiwei Yan)

Abstract: We study the matching of jobs to workers in a queue, e.g. a ridesharing platform dispatching drivers to pick up riders at an airport. Under FIFO dispatching, the heterogeneity in trip earnings incentivizes drivers to cherry-pick, increasing riders’ waiting time for a match and resulting in a loss of efficiency and reliability. We first present the direct FIFO mechanism, which offers lower-earning trips to drivers further down the queue. The option to skip the rest of the line incentivizes drivers to accept all dispatches, but the mechanism would be considered unfair since drivers closer to the head of the queue may have lower priority for trips to certain destinations. To avoid the use of unfair dispatch rules, we introduce a family of randomized FIFO mechanisms, which send declined trips gradually down the queue in a randomized manner. We prove that a randomized FIFO mechanism achieves the first best throughput and the second best revenue in equilibrium. Extensive counterfactual simulations using data from the City of Chicago demonstrate substantial improvements of revenue and throughput, highlighting the effectiveness of using waiting times to align incentives and reduce the variability in driver earnings.

[June 7, 2022] Jonathan Libgober (University of Southern California)

Date & Time: 2022/6/7 (Tue) 10:25-12:10

Title: Learning Underspecified Models (joint work with In-Koo Cho)

Abstract: This paper considers optimal pricing with a seller who does not possess a complete description of how actions translate into payoffs. We refer to a problem with this property as underspecified. To save computational costs, she delegates the pricing decision to an algorithm, in every period over an infinite horizon. Not knowing the true demand curve, the algorithm is tasked with ensuring that the optimal price emerges with sufficiently high probability, at a rate that is uniform over the set of possible demand curves. The monopolist views the complexity-profit tradeoff lexicographically, seeking an algorithm with a minimum number of parameters subject to achieving the same long run average payoff. For a large class of feasible demand curves, the optimum is achieved by an algorithms that assumes demand is linear even if it is not. Though misspecified, this saves on computational cost, and still achieves an attractive worst-case learning rate.

[May 31, 2022] Jacob Leshno (The University of Chicago Booth School of Business)

Date & Time: 2022/5/31 (Tue) 10:25-12:10

Title: Price Discovery in Waiting Lists: A Connection to Stochastic Gradient Descent (joint work with Itai Ashlagi, Pengyu Qian, and Amin Saberi)

Abstract: Waiting lists offer agents a choice among types of items and associated non-monetary prices given by required waiting times. These non-monetary prices are endogenously determined by a tâtonnement-like price discovery process: an item’s price increases when an agent queues for it, and decreases when an item arrives and a queuing agent is assigned. By drawing a connection between price adjustments in waiting lists and the stochastic gradient descent optimization algorithm, we show that the waiting list mechanism achieves allocative efficiency minus a loss due to price fluctuations that is bounded by the granularity of price changes. We further consider a price discovery process inspired by the waiting list mechanism and show that this simple price discovery process performs well if the granularity of price changes is chosen to appropriately trade-off the speed of price adaptation and loss from price fluctuations.

[May 24, 2022] Eric Budish (The University of Chicago Booth School of Business)

Date & Time: 2022/5/24 (Tue) 9:00-10:00

Title: The Economic Limits of Bitcoin and Anonymous, Decentralized Trust on the Blockchain

Abstract: Satoshi Nakamoto invented a new form of trust. This paper presents a three equation argument that Nakamoto’s new form of trust, while undeniably ingenious, is extremely expensive: the recurring, “flow” payments to the anonymous, decentralized compute power that maintains the trust must be large relative to the one-off, “stock” benefits of attacking the trust. This result also implies that the cost of securing the trust grows linearly with the potential value of attack — e.g., securing against a $1bn attack is 1000 times more expensive than securing against a $1m attack. Thus, if Bitcoin is to become significantly more economically useful than it is today, then the cost of maintaining Bitcoin must grow commensurately as well for it to remain trustworthy. A way out of this flow-stock argument is if both (i) the compute power used to maintain the trust is non-repurposable (as has been true for Bitcoin since mid-2013), and (ii) a successful attack would cause the economic value of the trust to collapse. However, vulnerability to economic collapse is itself a serious problem, and the model points to specific collapse scenarios. The analysis thus suggests a “pick your poison” economic critique of Bitcoin and its novel form of trust.

Cancelled [May 10, 2022] Xuan LI (The Hong Kong University of Science and Technology (HKUST))

Date & Time: 2022/5/10 (Tue) 10:25-12:10

Title: TBA

Abstract: TBA

[Apr. 28, 2022] Peng Shi (University of South California)

Date & Time: 2022/4/28 (Thu) 9:00-10:30

Title: Optimal Matchmaking Strategy in Two-Sided Marketplaces

Abstract: Online platforms that match customers with suitable service providers utilize a wide variety of matchmaking strategies: some create a searchable directory of one side of the market (i.e., Airbnb, Google Local Finder); some allow both sides of the market to search and initiate contact (i.e., Care.com, Upwork); others implement centralized matching (i.e., Amazon Home Services, TaskRabbit). This paper compares these strategies in terms of their efficiency of matchmaking, as proxied by the amount of communication needed to facilitate a good market outcome. The paper finds that the relative performance of the above matchmaking strategies is driven by whether the preferences of agents on each side of the market are easy to describe. Here, “easy to describe” means that the preferences can be inferred with sufficient accuracy based on responses to standardized questionnaires. For markets with suitable characteristics, each of the above matchmaking strategies can provide near-optimal performance guarantees according to an analysis based on information theory. The analysis provides prescriptive insights for online platforms.

[Apr. 26, 2022] Youjin Hahn (Yonsei University)

Date & Time: 2022/4/26 (Tue) 10:25-12:10

Title: Can STEM Learning Opportunities Reshape Gender Attitudes for Girls?: Field Evidence from Tanzania (joint work with So Yoon Ahn and Semee Yoon)

Abstract: We study how educational opportunities change adolescents’ gender attitudes in Tanzania, using an experiential education program focused on STEM subjects. After the intervention, girls’ gender attitudes became more progressive by 0.29 standard deviations, but boys’ gender attitudes did not change. Perceived improvement in the labor market opportunities appears to be an important channel to explain the result. The intervention also increased girls’ weekly study hours and boosted their interests in STEM-related subjects and occupations. Our results show that providing STEM-related educational opportunities to girls in developing countries can be an effective way of improving their gender attitudes.

[Apr. 12, 2022] Inga Deimen (University of Arizona)

Date & Time: 2022/4/12 (Tue) 10:25-12:10

Title: Communication in the Shadow of Catastrophe (joint work with Dezsö Szalay)

Abstract: We study the role of risk in strategic information transmission. We show that an increased likelihood of extreme states – heavier tails – decreases the amount of information transmission and makes it optimal to alter the mode of decision-making from communication to simple delegation. Moreover, the worst-case losses under communication increase relative to the worst-case losses under delegation when the tails get heavier.

[Apr. 5, 2022] Giovanni Compiani (The University of Chicago Booth School of Business)

Date & Time: 2022/4/5 (Tue) 10:25-12:10

Title: A Method to Estimate Discrete Choice Models that is Robust to Consumer Search